2019 NMHC Apartment Strategies

Outlook Conference Review

Apartment Outlook for 2019…

On January 29, the National Multifamily Housing Council held its 2019 Apartment Strategies Outlook Conference in San Diego, California, representing the most prestigious event in the apartment industry for trade data and networking. IPO was in attendance to gather market data for the last year and forecasts for the coming year for us to share with our clients. Several of the brightest and most talented people in the business presented their views for attendees and the prevailing theme was a solid outlook for operating fundamentals sprinkled with some caution over macroeconomic, interest rate, and cap rate concerns as the economy enters its 10th straight year of expansion. Let’s look at some of the more salient data points and takeaways we gleaned from the conference:

Volume: Sales activity has been setting year-over-year records and 2018 was no exception for multifamily sales, with nearly $175 Billion in sales, the highest level in 19 years and up 12.1% from 2017. Sales volume has increased every year since 2009 and it was projected at the NMHC conference that this trend would continue into 2019 but the torrid pace would likely begin to cool as interest rates inch up and investors become more risk-sensitive and price assets less aggressively with economic concerns on the horizon. There are historic amounts of capital -equity and debt – available for transactions and 2018 was a record year with $300 billion in financing activity for apartments, of which nearly half came from Fannie & Freddie. The ample flow of capital supports sales.

Supply: Delivery of new units in 2019 is slated to be slightly lower than it was in the “boom” construction years of 2014-2018 experienced in many Metros. It was a remarkable year for absorption in 2018, with the strongest rates since 2000, and the second year in a row where net absorption exceeds completions, a sign of how strong the demand is…

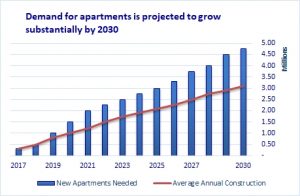

Demand: This topic best highlights why there has never been a better time to be in the apartment business. The NMHC estimates we need to build 4.6 million new apartments by 2030 to meet rising demand. That is an average of 325,000 new units completed per year nationwide. In 2018 we only delivered 275,000 units and 1989 was the last year we delivered over 325,000. Thus, there could be an extreme shortage of rental housing in the not-too-distant future and that begs the question of affordability given the relationship between supply and demand and rental rates…

Please click HERE to read the complete review